In Zimbabwe's dynamic real estate market, understanding the factors driving property prices is essential for both buyers and sellers. While various elements contribute to pricing, the fundamental forces of supply and demand play a central role in shaping the landscape. Let's delve into the intricacies of this relationship and explore why real estate is priced the way it is in Zimbabwe.

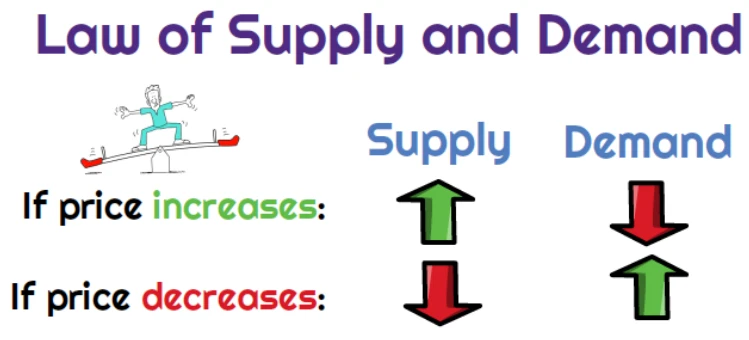

Supply and Demand Dynamics:

At its core, the price of real estate in Zimbabwe is influenced by the balance between supply and demand. It’s all about demand and supply and the high costs of construction. When demand for properties exceeds the available supply, prices tend to rise as buyers compete for limited inventory. Conversely, when supply outstrips demand, prices may stabilise or decline as sellers adjust their pricing strategies to attract buyers.

Demand Drivers:

Several factors contribute to the demand for real estate in Zimbabwe:

- Population Growth: With a growing population, there is a consistent demand for residential properties to accommodate housing needs.

- Urbanisation: Urban migration leads to increased demand for housing in cities and urban areas, driving up prices in these regions.

- Economic Stability: Improvements in the economy, job opportunities, and income levels can boost demand for real estate as more individuals seek homeownership or investment opportunities.

- Infrastructure Development: Investments in infrastructure such as roads, utilities, and amenities can enhance the desirability of certain areas, driving up demand and prices.

Supply Factors:

The supply of real estate is influenced by various factors as well:

- Land Availability: Limited availability of land, particularly in prime locations, can constrain the supply of properties, leading to higher prices.

- Regulatory Environment: Regulations governing land use, zoning, and development can impact the pace and scale of new construction, affecting supply dynamics.

- Construction Costs: Fluctuations in construction costs, including materials, labour, and regulatory fees, can influence the profitability of new developments and their impact on supply.

- Market Sentiment: Market conditions and investor sentiment can influence the pace of new development projects, impacting the overall supply of properties in the market.

Statistical Insights:

According to recent data from Seef Blog, the average property prices in Zimbabwe have [increased, decreased, or stabilised] by 5–7% over the past year compared to other SADC countries. This trend reflects the interplay between supply and demand dynamics, as well as broader economic factors shaping the real estate market.

Metrics

- High-density suburbs: USD17,000 to USD 40,000.

- Medium-density suburbs: USD50,000 to USD 120,000.

- Low-density suburbs: USD 150,000 to USD 1 million.

In Zimbabwe's real estate market, pricing is a complex interplay of supply and demand dynamics, influenced by various economic, demographic, and regulatory factors. By understanding these dynamics, buyers and sellers can make informed decisions and navigate the market with confidence. As the market continues to evolve, staying abreast of trends and developments is crucial for success in Zimbabwe's vibrant real estate landscape.

Continue with Facebook

Continue with Facebook

Continue with Email

Continue with Email